Owning a car means having insurance, no ifs, ands or butts. You will have a lot of different options when it comes to your insurance options. Take time to read any information available about auto insurance to help you get the best deal available for you.

Do your homework by comparing and contrasting different insurance plans before making your purchase. Even though insurance companies all have access to the same information in your driving record, they use it differently to decide what to charge as an insurance premium. When you check out several options, you will end up saving money.

Before you buy any “extras” for you car, have a conversation with your agent to see if this would change your auto insurance premiums. You may spend about a grand on some new rims for your car, but if an appraiser values them much lower the difference between the amounts will be lost if the car is stolen.

Most states require all drivers to have liability insurance. Remember that the responsibility for carrying the legally-required level of insurance lies with you, not your insurance company. Not having insurance will have you facing many financial and legal consequences if you get into an accident.

People think that the cost of insurance always goes down after people turn 25, but this is not always the case. The reality is that rates start going down around age 18 as long as it is a safe driver.

Your insurance coverage should never be permitted to run out, even when you are switching between plans. This will keep your insurance costs lower. If you keep switching insurance policy providers, your coverage will lapse, and rates will increase. An insurance company will raise your rate if they notice these gaps.

Save Money

Increase your deductibles and save money as a result. Although your premiums will be lower each month, this action can be chancy if you don’t have the self-control to save money for your deductible. In the event that you are involved in an auto accident, the out-of-pocket cost can be high. Your insurance rate will go down the higher your deductible is.

Obtain a record of discounts your provider offers, and thoroughly review it in search of discounts for which you qualify. Claiming these discounts can save you a surprising amount of money.

If you drive fewer than 7,500 miles in a year, you are likely to qualify for a discount with your insurance company. If you are aiming to save some cash on your auto insurance, cutting back on the number of miles you drive could be a good idea.

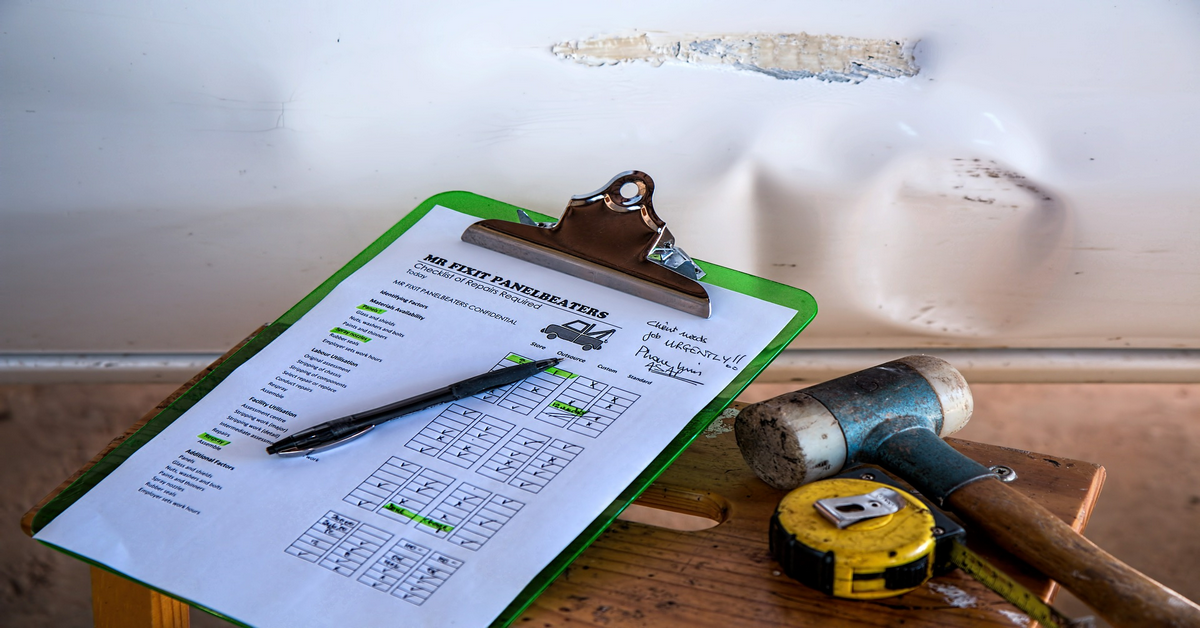

If you are ever in a car accident and need to file a claim, you should make it a point to thoroughly document everything related to the incident. Taking pictures with your cell phone is very helpful in recording any damage done where a claim must be filed. It can be a good idea to always carry a camera with you in the car, just in case.

100/200/100 level liability coverage is a good idea if you have an expensive car. Most states have minimum requirements for liability insurance coverage and it is important that your policy meets or exceeds all required coverage levels.

Consider paying your entire insurance policy in one payment. It’s common for it to cost more if you pay monthly due to service fees. Save your money now to pay off your insurance in one go, so that you save money later.

The consumer complaint ratio should be available for most of the car insurers in your state. This shows the percentage of claims that are met with complaints in a company.

If you wish to reduce your premium, think about agreeing to a more substantial deductible. The amount of your deductible is the biggest factor in determining how high your premiums will be. Remember that the deductible will be entirely your own responsibility if you find yourself in need of medical care. For this reason, among others, you should give serious consideration to establishing a fund for emergencies, as you just never know what may happen.

Be sure to remove people from your policy if they are not using your vehicle. By taking off drivers who no longer drive the vehicle, you can save money on lower premiums. Since driver under 25 pay higher rates, you can lower your monthly insurance premium by removing young drivers from your policy.

Reduce your premiums by going for the highest deductible you can afford. If you have a high deductible, it means you’re responsible for any repairs, but it still offers protection against total losses in which you’re liable. If your car has a low value, it is particularly suitable to choose a high deductible option.

Safety Features

Make a comprehensive list of your car’s safety features to squeeze out the lowest possible price for your insurance. You will find that safety features like air bags and alarms will get you a better rate on your insurance bill because of their ability to reduce future claims. You can receive the same benefit by retrofitting an older vehicle to include these features.

By consistently driving well, you can lower your auto insurance premium. If you drive well and do not get tickets, there is a good chance that you will qualify for a discount for being a good driver. It is costly to be a bad driver. Demonstrating a safe driving record can lower your car insurance premiums.

When looking at auto insurance, be sure you comprehend the laws of your place of residence. All states vary in the amount of minimum coverage they provide. Therefore, it is vital that you know what the requirements are before you buy a policy.

The price of insurance coverage varies from person to person. There are many factors, such as the type of car purchased and your driving record, that determine premiums. Certain people can get the same amount of coverage, if not more, and save money. You can become one of these people just by educating yourself further on the tricks of the auto insurance trade.

Customer Reviews

Thanks for submitting your comment!